The Simple Way to Get Started With Budgeting

If you haven’t had to budget before, learning how to get started with budgeting might seem a bit overwhelming at first. Taking it step by step can help, starting with taking a step back.

The first step to get stared with budgeting is taking a deep breath and slowing down. Once you have time for yourself, open up your favorite spreadsheet program or calendar app and find out what’s going on with your finances. Below is a step by step path to get started with budgeting, and I know that once you start properly, you’ll be hooked on the process and working your way toward your financial goals.

Assess the Situation

Focus on the numbers you have at hand, not the numbers you’d like to have. This means writing down every penny that comes into the household on a regular basis: your income from working, minus taxes and other deductions, and any other income you might have coming in.

You also need to list out all monthly expenses. If it’s an expense that only comes around once a year, there are two ways you could handle them: divide the expense by 12 and list that amount monthly, or you could just list it one month a year and pay it all at once. If you have the funds to pay it all at once, that’s usually ideal, but I know it’s not always that easy!

Take another peek at your bank statements for the past few months (most online banks let you access at least the last 90 days). This is a good way to find any expenses that you may have forgotten about. Don’t forget about credit cards, paypal, venmo, and other ways you buy things.

Divide Expenses Into Categories

Some of your expenses will be the same every month, such as your mortgage payment or cell phone bill. Others are variable, such as Electric and other bills that depend on how much you use them. You can either add up the variable monthly numbers and divide by 12 to get an average for that category, or use the highest number for the year and plug that in for every month.

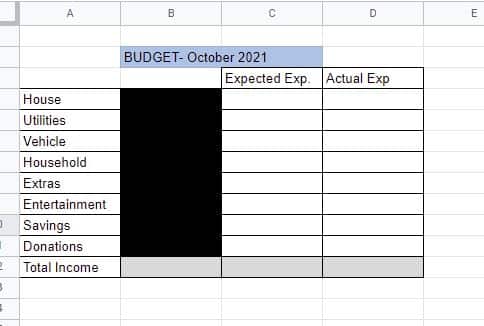

General categories for budgeting:

Divide the expenses into the following categories. This list should cover almost everything.

- House: mortgage/rent, property tax, insurance, repairs, etc

- Utilities: electric, gas, water, etc.

- Vehicle: payment, gas, maintenance

- Household: groceries, pet care

- Extras: cell phone, cable, internet, etc.

- Entertainment: eating out, movie rentals, etc.

- Savings

- Donations

You will want to add some extra categories that fit best with your personal or family expenses, but those are some general ideas to get you started.

Weigh It Out

Once you complete the above exercises, you can see if you are spending more than you’re bringing in. If that’s the case, it’s time to reign it in a bit. You can reduce your expenses (reduce spending) or you can make more money. It’s important that you are spending within the range of your income, or underneath it. If you need to make more each month, consider a part time job or working online. If you just need a few extra payments to catch up on things, a yard sale or selling some extra things that you have on Facebook Marketplace might be a better option.

Is it Working?

Now you should have a budget! On a spreadsheet, or even on paper, create three columns. One column for income, another column for expected expenses, and then a column for your actual expenses. Keep track of all of the above categories on a monthly basis. You don’t need any fancy software – I just made this one quickly on Google Sheets. As long as your expected expenses are about the same as your actual expenses, and you’re not spending more than you make, this budget is valid. If for some reason your expenses go up or your income goes down, it will be time to re-work your budget again to keep it current.

Create Budget Goals

You did it! You were able to get started with budgeting, and you made a simple budget for yourself or your family and you’ve learned how to track your expenses to make sure you’re on track. But now what??

Once you’re comfortable with your budget, you’ll want to decide what your money goals are, and then adjust the budget so that you can accomplish those goals.

Some goals you might have would be to pay off a debt sooner, put more money in savings or donations, or to add another category like Gifts or Vacations. Reaching those goals might require you to reduce your expenses in other areas, or increase your earnings. Regardless, creating those goals will make your budget a living document that is super helpful when trying to figure out what the next steps in your money future are.

Need to Make More Money? Consider a Passive Income Stream Selling Printables on Etsy. This course taught me everything I know.