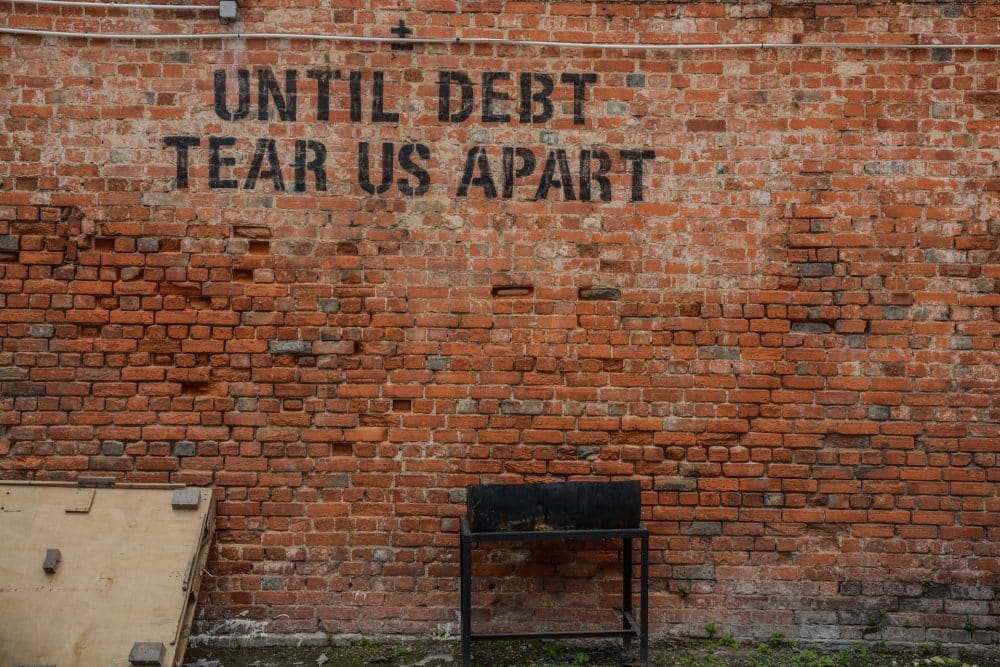

Should You Focus on One Bill or Make Multiple Minimum Payments?

As we’ve discussed often, debt can feel so overwhelming. If you owe money to multiple lenders, the situations gets even trickier. You only have so much money to use each month. Should you focus on one bill or multiple minimum payments? What’s the best way to get the debt down? Always Make Your Minimum Payments […]

Dealing with the critical issues associated with demo trading

Many are surprised to find out this article but not all benefits are designed for traders. As this is a financial sector, it is no wonder the brokers are trying to make a profit out of every investor. If you have any doubt, open a demo account and you will discover that the majority of […]

What My Financial Personality Says About Me

I recently received an email from Marcus by Goldman Sachs. It gave me the opportunity to take a quiz to determine my financial personality. I’m always intrigued by these types of things, so I went ahead and answered the ten questions to see if I could learn a bit more about my financial self. About […]

What Are Your Rights When Your Salary Is Delayed?

One of the perks of having an employer is that you get a steady paycheck. You show up and do the job every day. In exchange, you get a paycheck every week, every other week, or every month. But sometimes things go awry and your employer can’t pay you. What are your rights when your […]

How To Earn Extra Bucks by Creating Slogans

We are turning into a side-hustle nation. Everyone I know and those I meet have a hustle. Mine, as you know, is writing. Some people in my circle do taxes, clean businesses, and homes, and even create websites for others. If you’re looking for a side hustle, there are a million out there. One that […]

Simplify: 7 Areas to Reduce Spending

Recently I mentioned that I was reading 7 Days of Simplicity by Jen Hatmaker. In this book, the author explores seven different areas of life to simplify. Simplifying in each of these areas can also reduce spending. Here’s a closer look at how I can apply this to my own life: 1. Reduce Spending in […]

How To Settle Debt With Credit Card Lender

Do you have too much credit card debt? If so, you’re not alone. The average American household has well over $5000 of credit card debt. The exact numbers vary by study but $8000 isn’t uncommon. Of course, that’s cold comfort if you’re stuck trying to make payments that you can’t afford. Don’t worry; you have […]

Should I Go Back to Using a Checkbook?

A book that I’m reading makes a pretty solid argument for a return to the days of using checkbooks. I haven’t written checks in well over a decade. Would it make any sense to go back to using a checkbook? The Inspiration for The Idea I’ve been reading “7 Days of Simplicity: A Season of […]

5 Money Mistakes I Made This Month

I think it’s important to be honest with ourselves when it comes to our money. Moreover, it’s important to take stock of our personal finances regularly. Doing so allows us to nip problems in the bud. We become accountable to ourselves, which helps us financially. Therefore, here are five money mistakes I want to own […]

Social Security Eligibility and Earnings

Today, I was scrolling through Facebook. I saw a post that stood out to me. Someone from a financial group I am in posted about social security benefits. He alerted everyone in the group to check out their credits today. He said checking them could provide useful to anyone wanting to retire early and still […]